Dow Jones Industrial Average surges higher after NFP jobs beat forecasts

- The Dow Jones climbed into fresh 21-week highs on Thursday.

- US NFP job gains handily beat forecasts, thumping market fears of labor weakness.

- Markets are geared up for an early closure this week ahead of Friday’s US holiday.

The Dow Jones Industrial Average (DJIA) punched in firm gains on Thursday, testing its highest bids in five months after US Nonfarm Payrolls (NFP) showed more jobs were added in June on a seasonally-adjusted basis than markets feared. ADP job numbers earlier this week hinted at a contraction in overall US employment last month, sparking fresh investor fears that the US’s employment segment was beginning to show cracks in the foundation.

NFP beats the street as government hiring surges

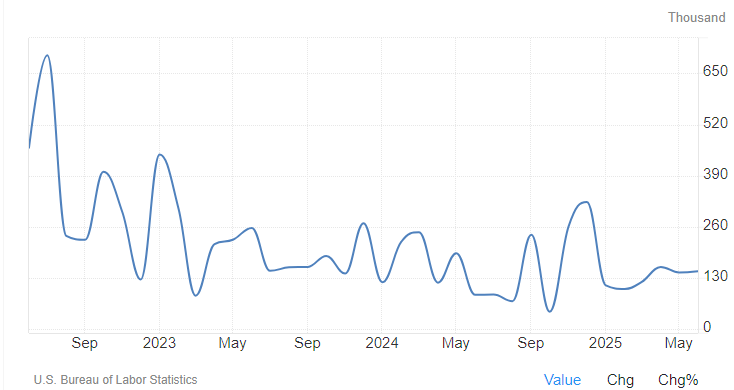

US NFP figures showed a net gain of 147K new jobs through June, beating the median market forecast of 110K. The previous month’s figure was also revised higher to 144K, functionally ending this week’s broad-market fears of sputtering job growth. However, not all is as rosy as it appears in the headlines: around half of all job gains posted in June came from state and local government hiring (+73K), closely followed by more job gains in health care services (+58.6K), with leisure and hospitality hiring coming up in third (+20K). With most government hiring taking place in the education sector, analysts are throwing up early warning signs that it is incredibly unlikely that state and local governments will be able to maintain this pace of job creation.

(source: tradingeconomics.com)

Business services (-7K), manufacturing (-7K), wholesale trade (-6.6K), and resource extraction, including mining and logging (-2K), all shed jobs through June. Most of the month’s job gains came from government expense roles, and with the shrinkage in ‘real’ economy jobs, June’s NFP beat, while strong, is nonetheless an expensive one.

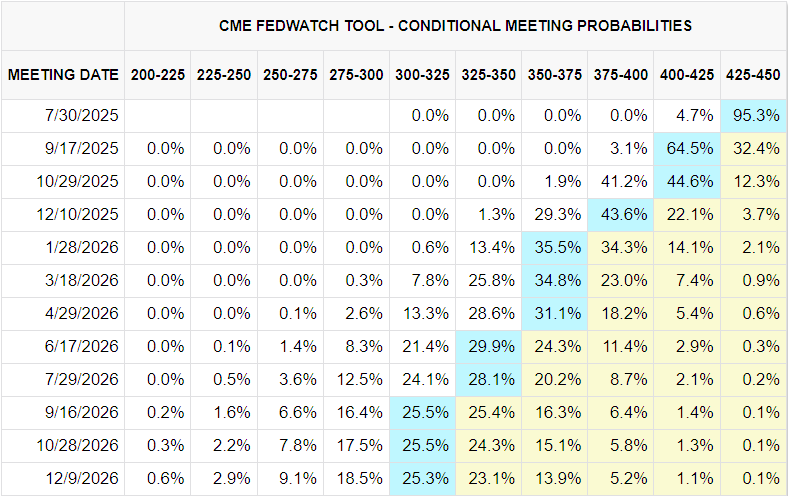

Strong gains on headline NFP net job gains have also pummeled broad-market rate cut hopes. June’s jobs beat has obliterated any market expectations for a rate cut at the Federal Reserve’s (Fed) upcoming rate call at the end of the month, and odds of three rate cuts before the end of the year have also been called into question.

US equity markets closed early on Thursday, going dark at 5:00 pm GMT/1 pm EST. Markets will remain shuttered through Friday for the US Independence Day holiday, and will return to the fold next week.

(source: cmegroup.com)

Dow Jones price forecast

June just started, and the Dow Jones Industrial Average is already on pace to chalk in a third straight month of gains. The Dow Jones is up over 22% from its post-tariff announcement lows near 36,600, testing the 44,800 region and on pace to rechallenge all-time highs just above 45,000.

The Dow Jones has gained ground for all but two of the last nine consecutive sessions. Price action remains firmly pinned to the high end, keeping technical oscillators buried in overbought territory. A downside correction will help blow off tightly-packed bullish pressure, and it will take a significant decline in daily bids to bring the Dow back down to the 200-day Exponential Moving Average (EMA) near the 42,000 handle.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.