GBP/USD slips below 1.3450 as NFPs slash January Fed cut bets

- GBP/USD pulls back as weak job gains are offset by a lower unemployment rate, reinforcing labor market resilience.

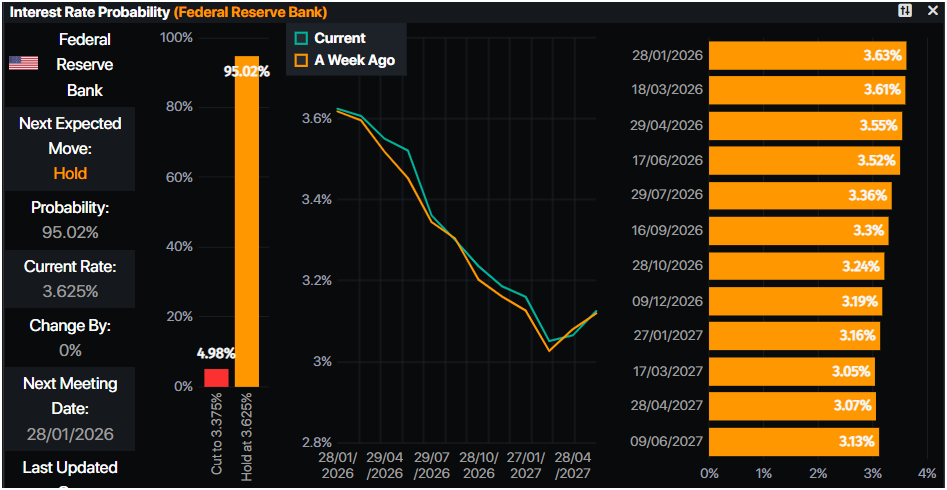

- Markets slash January Fed rate-cut odds after NFPs, supporting the Dollar despite softer housing data.

- Focus turns to UK retail sales, jobs, and GDP data next week for fresh Sterling catalysts.

The Pound Sterling retraces on Friday after December’s Nonfarm Payrolls report delivered mixed figures, though traders reduced bets for an interest rate cut in January. At the time of writing, the GBP/USD trades at 1.3412 after reaching a high of 1.3451.

Sterling retreats on mixed US payrolls data, traders pare near-term easing expectations

The US Bureau of Labor Statistics (BLS) revealed that the economy added just 50K people to the workforce, below estimates of 60K and the previous print of 64K. Although the print shows signs of weakness, the Unemployment Rate edged lower from 4.6% to 4.4%, beneath forecasts of 4.5%.

The report reaffirmed Fed officials’ comments that the labor market is in a no-firing, no-hiring environment and traders perceived the report as solid as they trimmed the chances for a rate cut in January from around 29% to nearly 5%, revealed Prime Market Terminal data

US housing data and Consumer Sentiment was worse than expected

At the same time, Building Permits for October in the US dipped 0.2% from September’s 1.415 million to 1.412 million. Private-owned Housing Starts in October came to 1.246 million, for a 4.6% decline from September print of 1.306 million.

Recently, the University of Michigan Consumer Sentiment preliminary reading in January exceeded economists’ forecast of 53.5, came at 54, improved from November’s final reading of 52.9. Inflation expectations for 1-year were unchanged at 4.2% and for a five-year period rose from 3.2% to 3.4%.

Across the pond, the UK’s economic docket was absent, yet it is expected to gain traction, next week. The BRC Like-For-Lile Retail Sales data for December is awaited, UK’s jobs data and the release of GDP figures.

GBP/USD Price Forecast: Technical outlook

The GBP/USD extended its downtrend and seems poised to challenge the 200-day SMA at 1.3384. A daily close below the latter could cement the case for testing the 50-day SMA at 1.3288, before sellers push to drive the exchange rate to 1.3200.

Conversely, buyers need to reclaim 1.3450 and on further weakness, reach the 1.3500 mark.

Pound Sterling Price This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.85% | 0.44% | 0.82% | 1.10% | 0.02% | 0.71% | 1.12% | |

| EUR | -0.85% | -0.40% | 0.02% | 0.25% | -0.81% | -0.14% | 0.27% | |

| GBP | -0.44% | 0.40% | 0.32% | 0.66% | -0.41% | 0.27% | 0.68% | |

| JPY | -0.82% | -0.02% | -0.32% | 0.27% | -0.81% | -0.12% | 0.34% | |

| CAD | -1.10% | -0.25% | -0.66% | -0.27% | -0.92% | -0.40% | 0.02% | |

| AUD | -0.02% | 0.81% | 0.41% | 0.81% | 0.92% | 0.69% | 1.11% | |

| NZD | -0.71% | 0.14% | -0.27% | 0.12% | 0.40% | -0.69% | 0.42% | |

| CHF | -1.12% | -0.27% | -0.68% | -0.34% | -0.02% | -1.11% | -0.42% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).