US Dollar Index tumbles as Fed rate outlook widens

- The US Dollar Index caught a leg lower on Wednesday after the Fed delivered a third straight rate cut.

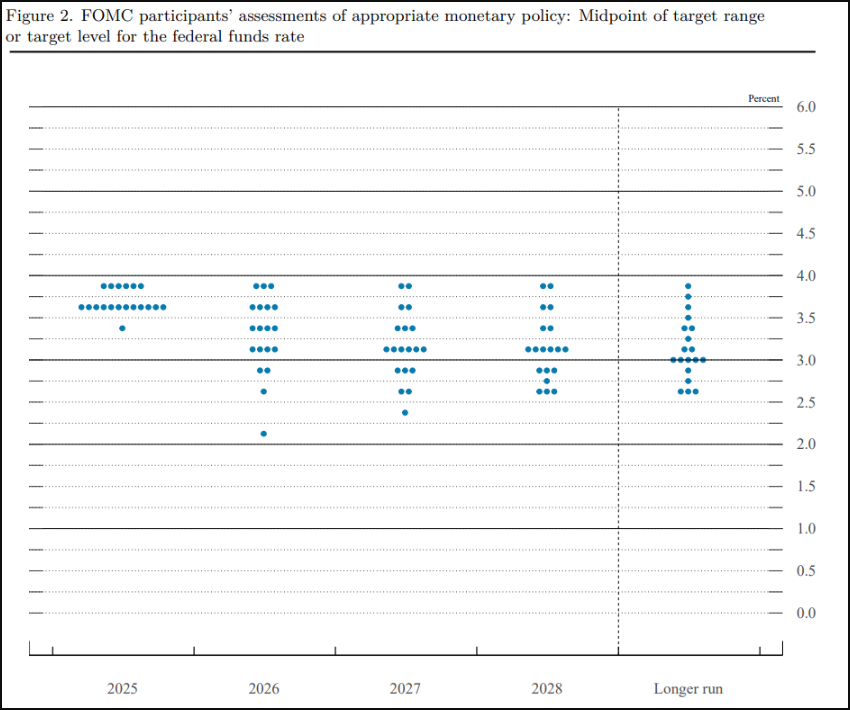

- The FOMC has seen a sharp widening of policymaker expectations, opening the door for more QE and further rate trims.

The US Dollar Index (DXY) tumbled to fresh intraday lows on Wednesday after the Federal Reserve (Fed) delivered a widely anticipated third straight interest rate cut, lowering its main policy rate to its lowest level in three years.

The Federal Open Market Committee (FOMC) voted nine-to-three in favor of another quarter-point interest rate cut. One policymaker preferred a larger cut of 50 basis points, while two members opted for no cuts at all.

As we approach the end of the year, the range of FOMC policy outlooks has expanded. However, markets are particularly focused on a notable hawkish tilt in the Fed's economic outlook for 2026, as reflected in the latest update to the Summary of Economic Projections (SEP). The dot plot of FOMC interest rate expectations has also diversified, but investors are paying attention to an increasing number of Fed policymakers who anticipate two or more interest rate cuts in the upcoming year.

More to come...

DXY 5-minute chart

Economic Indicator

Fed Interest Rate Decision

The Federal Reserve (Fed) deliberates on monetary policy and makes a decision on interest rates at eight pre-scheduled meetings per year. It has two mandates: to keep inflation at 2%, and to maintain full employment. Its main tool for achieving this is by setting interest rates – both at which it lends to banks and banks lend to each other. If it decides to hike rates, the US Dollar (USD) tends to strengthen as it attracts more foreign capital inflows. If it cuts rates, it tends to weaken the USD as capital drains out to countries offering higher returns. If rates are left unchanged, attention turns to the tone of the Federal Open Market Committee (FOMC) statement, and whether it is hawkish (expectant of higher future interest rates), or dovish (expectant of lower future rates).

Read more.Last release: Wed Dec 10, 2025 19:00

Frequency: Irregular

Actual: 3.75%

Consensus: 3.75%

Previous: 4%

Source: Federal Reserve

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.