Dow Jones Industrial Average climbs 100 points as bullish sentiment persists

- The Dow Jones climbed 100 points on a wobbly Tuesday as investors tilt bullish.

- Equity markets remain hopeful heading into the year's end.

- Looming holiday closures keep overall market momentum capped.

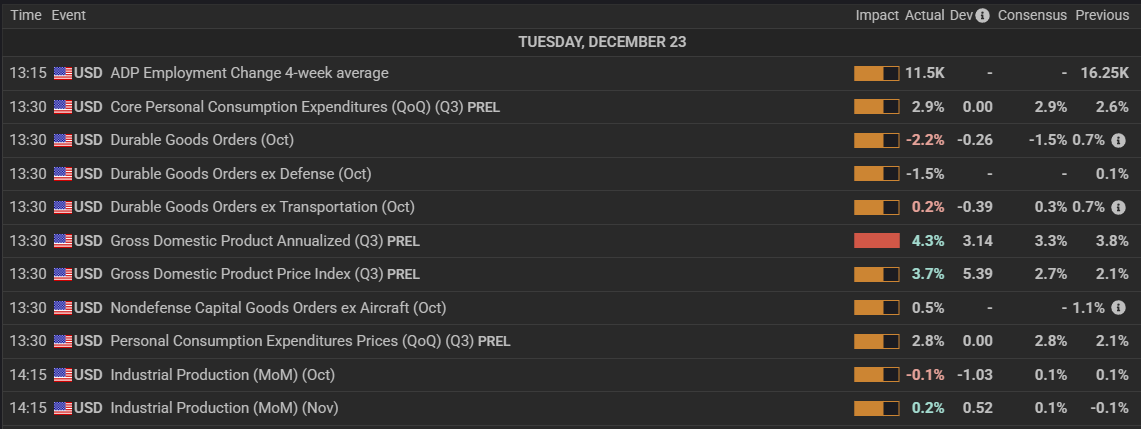

- US GDP accelerated in the third quarter, but consumers remain skeptical.

US stocks extended their recent rally on Tuesday, with major indexes posting a fourth consecutive day of gains as investors continued to favor artificial intelligence–related names during a holiday-shortened trading week. The advance kept the S&P 500 (SP500) within striking distance of fresh record highs, reinforcing the market’s resilient tone even in the face of stronger-than-expected economic data.

Equities recover footing as rate cut hopes persist

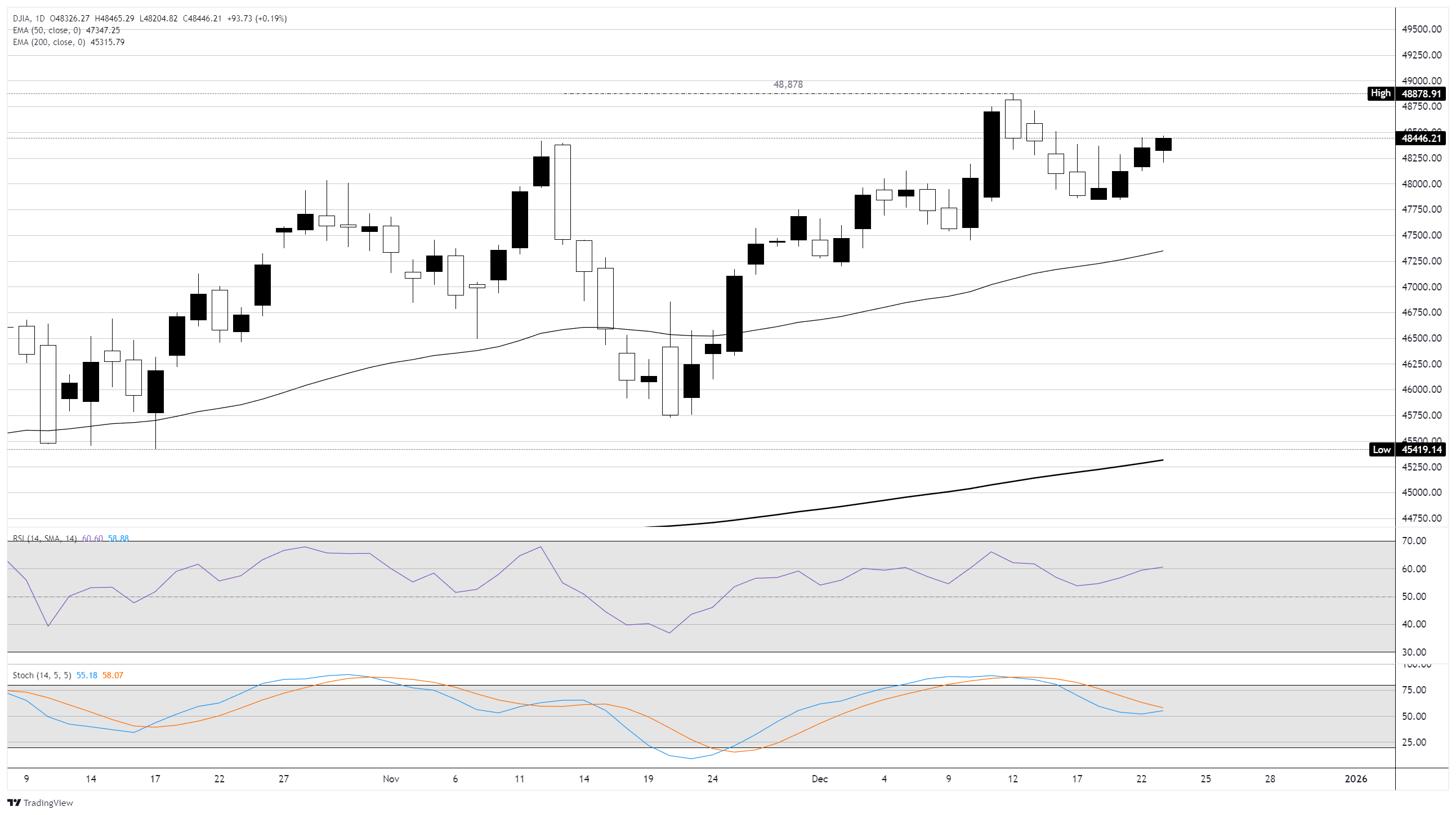

The S&P 500 rose about 0.3%, hovering just below the 6,900 level and near both its intraday and closing records. The Nasdaq Composite outperformed with a gain of roughly 0.4%, supported by ongoing strength in large-cap technology and AI-linked stocks. The Dow Jones Industrial Average (DJIA) also edged higher, adding about 100 points. Not all corners of the market participated, however, as small-cap stocks lagged. The Russell 2000 declined around 0.6%, reflecting investor caution toward more economically sensitive companies amid signs of robust growth.

Markets digested a delayed but closely watched economic report showing US Gross Domestic Product (GDP) growth expanded at a 4.3% annualized pace in the third quarter, significantly exceeding expectations. Growth was driven by resilient consumer spending, which accelerated from the prior quarter. The upside surprise briefly unsettled markets early in the session, as investors reassessed how quickly the Federal Reserve (Fed) might move to lower interest rates. Despite that initial hesitation, stocks recovered as traders maintained confidence that multiple rate cuts remain likely next year.

Futures markets continue to price in two Fed rate cuts by the end of next year, even as stronger growth complicates the near-term outlook. Some investors also remain focused on potential changes in Fed leadership, with expectations that a future chair could lean more dovish than current policymakers. For now, the market appears willing to look past near-term economic strength and focus on a longer-term easing cycle.

Consumers remain cautious despite upshot data

Sentiment data offered a more cautious signal. The Conference Board (CB) reported that consumer confidence fell again in December, underscoring lingering concerns about the economic outlook despite strong headline growth. Four of the five components of the index declined, leaving overall confidence well below levels seen earlier in the year and suggesting households remain uneasy about future conditions.

Elsewhere, institutional news drew attention as Citadel plans to return roughly $5 billion in profits to investors early next year. The hedge fund’s flagship Wellington strategy has posted solid gains so far this year, highlighting continued strength among large alternative asset managers.

In commodities markets, precious metals surged to fresh records. Gold futures reached a new all-time high above $4,530 an ounce, while silver climbed past $70 an ounce for the first time ever on a nominal basis. The moves reflected ongoing demand for hard assets amid expectations of future rate cuts and longer-term inflation concerns.

With US markets set to close early on Christmas Eve and remain shut on Christmas Day, investors are entering the holiday period with equities near record levels, supported by optimism around technology leadership, a resilient economy, and the prospect of easier monetary policy ahead.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.